fulton county ga property tax sales

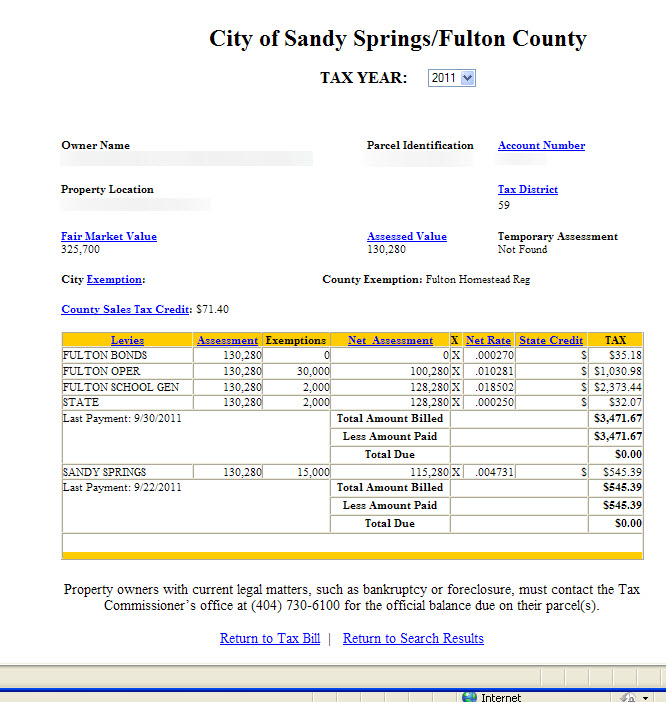

The City of South Fulton property taxes also known as ad valorem taxes are billed and collected through Fulton County Tax Commissioners office. Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA.

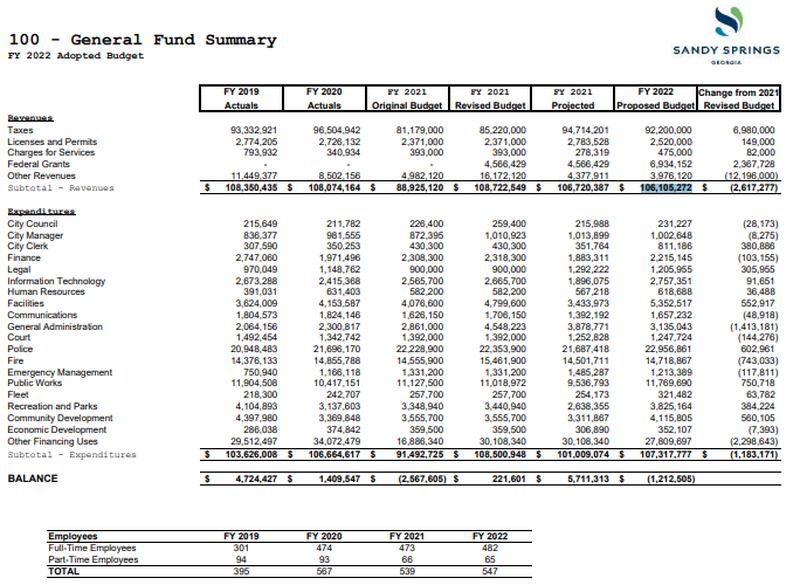

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

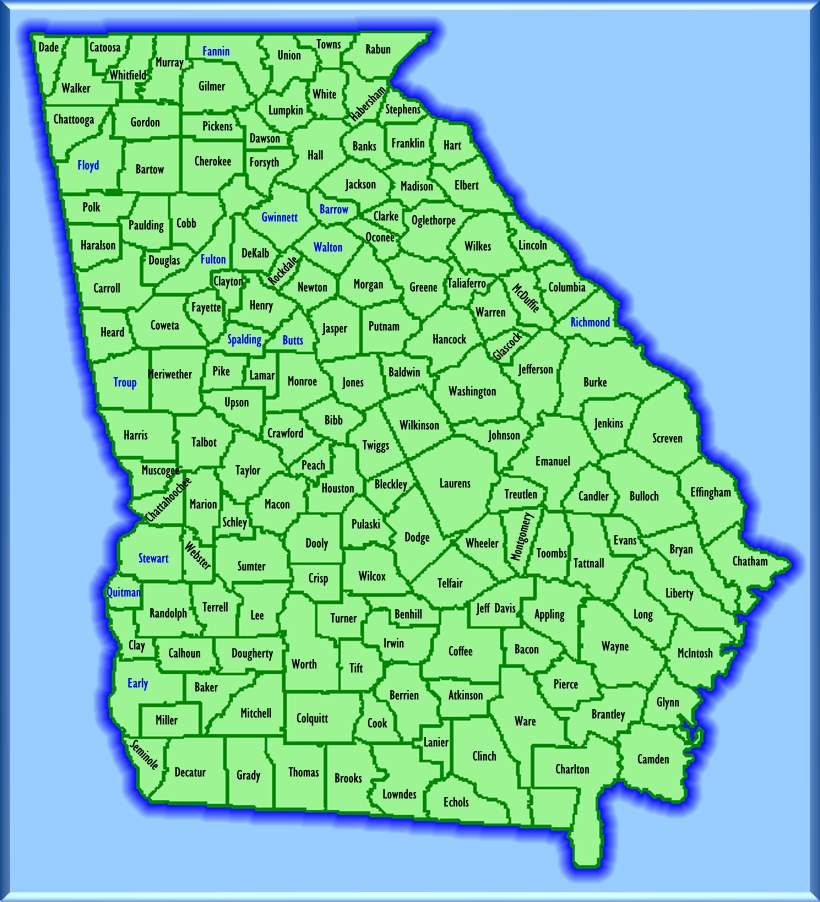

Ferdinand is elected by the voters of Fulton County.

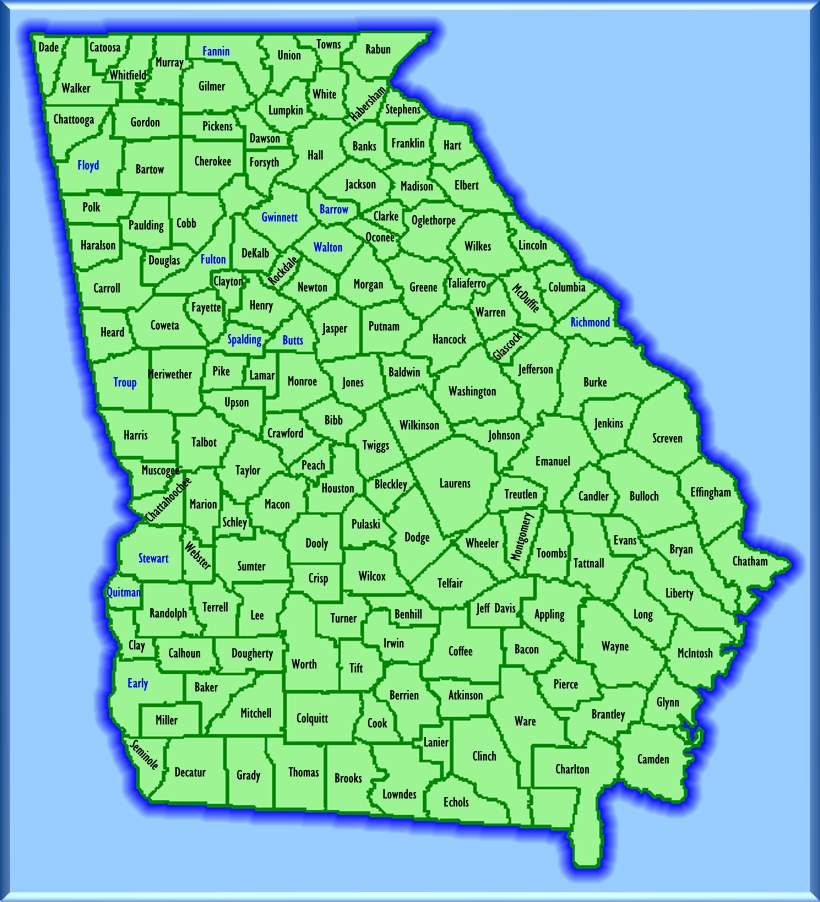

. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales. Tax Sales-Excess Funds Procedure Application.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set. Bidder ID cards will not be issued after the tax sale is under way The information entered in the following application will be used to. Atlanta GA 30303.

Taxpayer Refund Request Form. Fulton County has a combined sales tax of 775 percent outside of Atlanta 89 percent inside Atlanta. Tax Sales - Bidder Registration.

Fulton County Sheriffs Office. To review the rules in Georgia visit our state-by-state guide. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide. 1 April 1.

Fulton County Tax Commissioner Dr. Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Georgia 30303 404-612-6440.

The 2018 United States Supreme Court decision in South Dakota v. Click this link to access SmartFile. Atlanta GA 30303.

Find Mortgage Tax and Sale History Records for Millions of Homes Nationwide. Automating sales tax compliance can help your business keep compliant. Ad Detailed listings of foreclosures short sales auction homes land bank properties.

Fulton County GA currently has 226 tax liens available as of April 15. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set. Please type the text you see in the image into the text box and submit.

Fulton County Initiatives Fulton County Initiatives. The Georgia state sales tax rate is currently 4. Ad Discover Hidden Info That Might Affect the Value of a Property.

Real Property Returns Jan. This page contains local information about a specific county. Infrastructure For All.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. These buyers bid for an interest rate on the taxes owed and the right to collect. Has impacted many state nexus laws and sales tax collection requirements.

Approved and adopted September 2 2020. County Property Tax Facts Fulton On this page. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

The Weve posted a new list for the upcoming tax sale in Fulton County GA on 2015-12-01 - containing 71 properties. Fulton County GA currently has 3661 tax liens available as of April 15. All taxes on the parcel in question must be paid in full prior to making a refund request.

Fulton County collects an additional 375 percent which is consistent with other metro Atlanta counties. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Houses 9 days ago The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses.

Online filing is available by using our SmartFile system. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions. The Fulton County sales tax rate is 26.

To obtain a copy of a 2020 or prior tax statement please go to the Fulton County Tax Commissioners website. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. The tax parcel dataset is used primarily in support of the Fulton County Board of Assessors mission of appraising properties and building the annual tax digest.

Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Please fully complete this form.

185 Central Ave 9th Floor. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax.

Please submit no faxesemails the required documentation for review to the following address below. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. The 2020 Millage Rate is 12899 0012899.

Online registrations must be verified in-person between 830 AM and 945 AM on the day of the tax sale. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales. Present your photo ID when you arrive to receive your bidder ID card.

Fulton County Board of Assessors. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Georgia state sales and use tax rate is 4 percent.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Property Taxes - Fulton County Georgia.

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

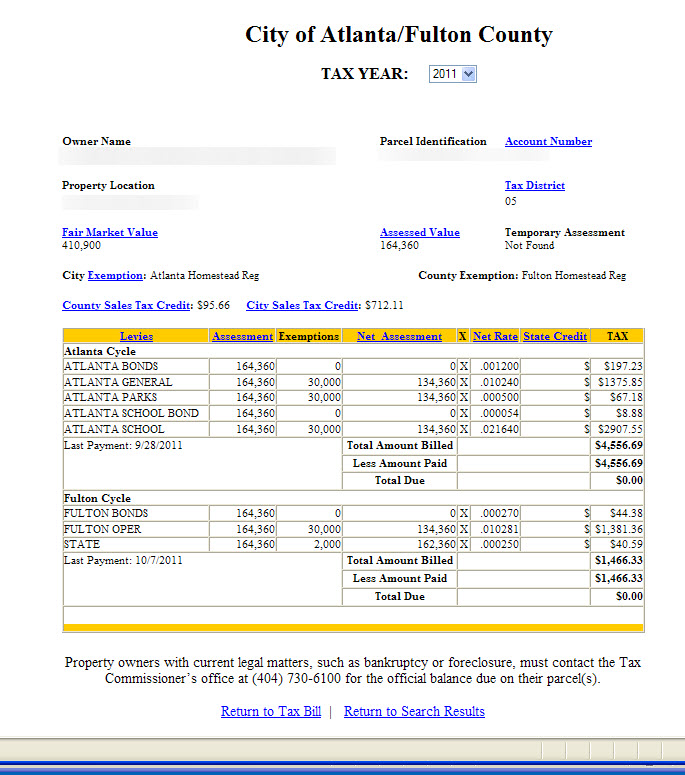

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

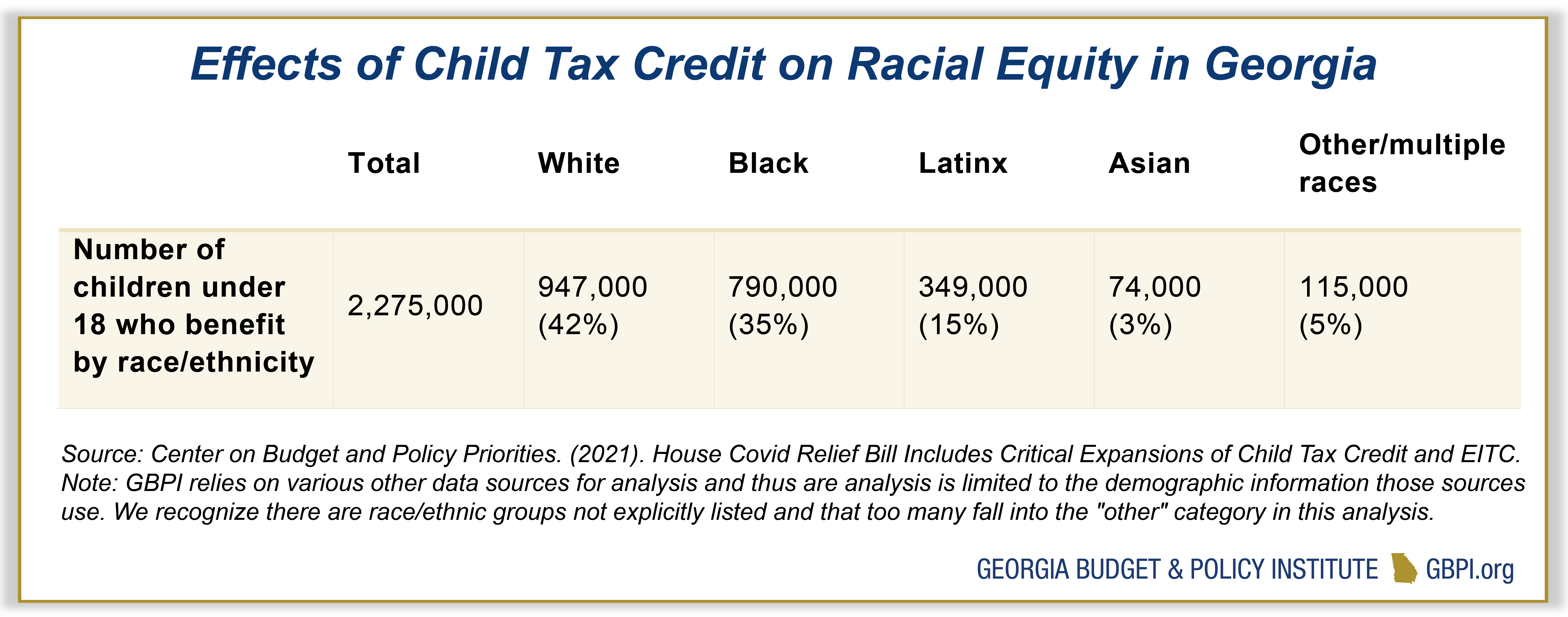

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Transfer Of Tax Fifa S In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Fulton County Board Of Assessors

Milton Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Property Tax Appeal Blog Georgia Property Tax Assessment

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Property Taxes South Fulton Ga

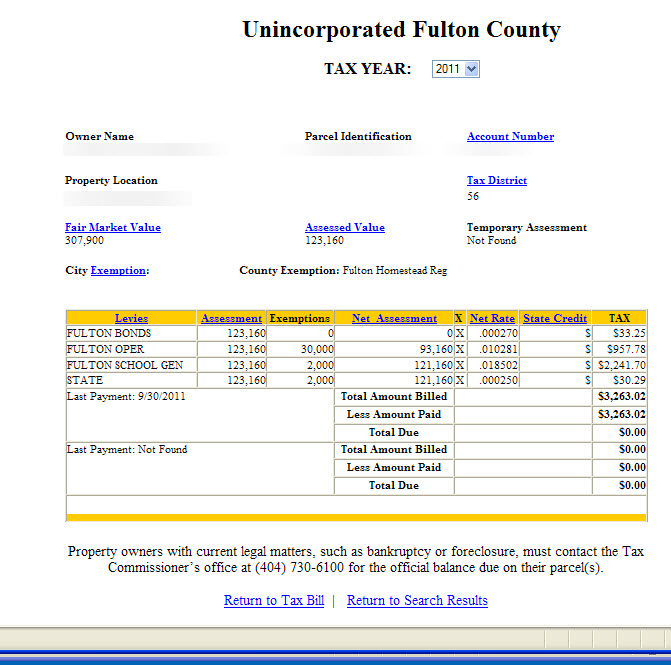

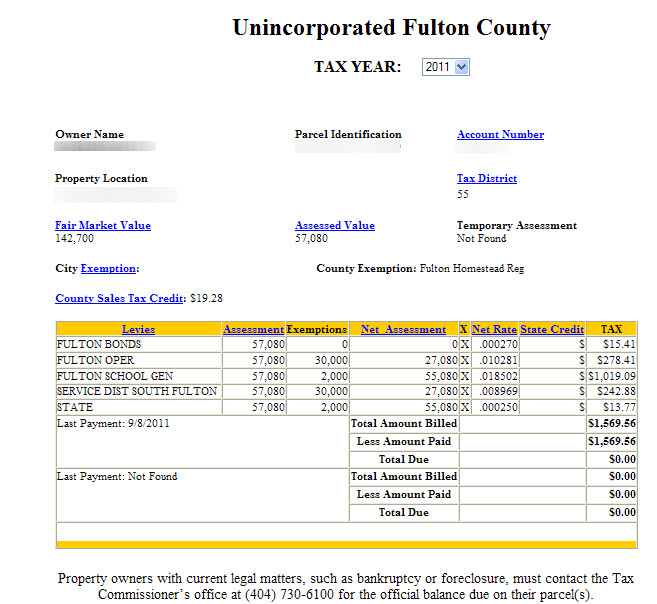

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

1080 Birchdale Dr Alpharetta Ga 5 Beds 4 Baths Redfin Home Outdoor Structures